Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Price Action

- Thread starter Kooka30

- Start date

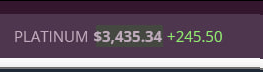

I've never followed it. I mean, I'm a small fish so I can't spread myself to thin. Anyway I only looked because Bob Moriarty mentioned it in a video I watched today saying you've missed the boat. Checked and saw the above (it's $60 more since then)Pt heads finally getting their day.

At the same time, we are hearing reports that BYD is scrambling to front-run Samsung , seeking to secure as much as 40,000 metric tonnes of silver for its silver solid-state EV battery programme in 2026. If accurate, the implications for physical supply are profound.

Of course there is something to all those things. But the mainstream carefully overlooks what is likely the biggest cause of the stunning revival of the monetary metals: the long-overdue calling of the short derivatives positions in both metals that has been operated for decades by the U.S. government, its closest allies, and their bullion bank agents.

Delivery of real metal now is being demanded against paper claims on metal, claims that were issued by bullion banks that never had to deliver it, thereby allowing gold and silver supplies to be oversubscribed by as much as 90 or 100 to 1.

Only a short squeeze can plausibly explain the violent price action in silver today, when the metal rose in price by as much as $7 or 10%. One-day action like that in the metals has not been seen for decades.

The squeeze is evident in the huge discrepancy between prices in Shanghai, India, London, and New York. Prices in Shanghai and India are far higher, creating an arbitrage opportunity that has been draining metal out of the West, metal that in many cases has multiple owners and isn't readily available.

Examining this angle -- the creation of vast imaginary supplies of the monetary metals in order to protect the dollar as the world reserve currency, maintain faith in U.S. government debt, and impoverish the rest of the world -- might explode what's left of the world's political order, an unjust, imperialistic order that should be exploded.

Examining this angle also might fatally discredit the mainstream news organizations and analysts who aren't capable of honesty in a matter so important.

If you doubt any of this, please review the documentation GATA long has assembled and maintained here:

Delivery of real metal now is being demanded against paper claims on metal, claims that were issued by bullion banks that never had to deliver it, thereby allowing gold and silver supplies to be oversubscribed by as much as 90 or 100 to 1.

Only a short squeeze can plausibly explain the violent price action in silver today, when the metal rose in price by as much as $7 or 10%. One-day action like that in the metals has not been seen for decades.

The squeeze is evident in the huge discrepancy between prices in Shanghai, India, London, and New York. Prices in Shanghai and India are far higher, creating an arbitrage opportunity that has been draining metal out of the West, metal that in many cases has multiple owners and isn't readily available.

Examining this angle -- the creation of vast imaginary supplies of the monetary metals in order to protect the dollar as the world reserve currency, maintain faith in U.S. government debt, and impoverish the rest of the world -- might explode what's left of the world's political order, an unjust, imperialistic order that should be exploded.

Examining this angle also might fatally discredit the mainstream news organizations and analysts who aren't capable of honesty in a matter so important.

If you doubt any of this, please review the documentation GATA long has assembled and maintained here:

The USD, reserve currency, like every other PONZI Scheme is finally playing out it's final act.Of course there is something to all those things. But the mainstream carefully overlooks what is likely the biggest cause of the stunning revival of the monetary metals: the long-overdue calling of the short derivatives positions in both metals that has been operated for decades by the U.S. government, its closest allies, and their bullion bank agents.

Delivery of real metal now is being demanded against paper claims on metal, claims that were issued by bullion banks that never had to deliver it, thereby allowing gold and silver supplies to be oversubscribed by as much as 90 or 100 to 1.

Only a short squeeze can plausibly explain the violent price action in silver today, when the metal rose in price by as much as $7 or 10%. One-day action like that in the metals has not been seen for decades.

The squeeze is evident in the huge discrepancy between prices in Shanghai, India, London, and New York. Prices in Shanghai and India are far higher, creating an arbitrage opportunity that has been draining metal out of the West, metal that in many cases has multiple owners and isn't readily available.

Examining this angle -- the creation of vast imaginary supplies of the monetary metals in order to protect the dollar as the world reserve currency, maintain faith in U.S. government debt, and impoverish the rest of the world -- might explode what's left of the world's political order, an unjust, imperialistic order that should be exploded.

Examining this angle also might fatally discredit the mainstream news organizations and analysts who aren't capable of honesty in a matter so important.

If you doubt any of this, please review the documentation GATA long has assembled and maintained here:

I have no idea of the timeline.

But it does seem to be accelerating.

View attachment 15534

pensions funds will allocate

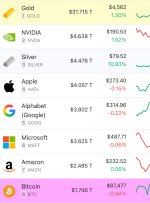

Are they measuring the market cap of silver in total silver ever mined? It's the only way that $4.4T makes sense.

56 Billion Oz's mined throughout history. $79 USD per ounce = $4.4 Trillion.

That's a weird way to measure silvers market cap, especially when only a fraction of that is available supply, and only a portion of it is even recoverable.

Yeah, I smell some BullshitAre they measuring the market cap of silver in total silver ever mined? It's the only way that $4.4T makes sense.

56 Billion Oz's mined throughout history. $79 USD per ounce = $4.4 Trillion.

That's a weird way to measure silvers market cap, especially when only a fraction of that is available supply, and only a portion of it is even recoverable.

Maybe there are counting what they thinks still in the ground also