Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Price Watch

- Thread starter STKR

- Start date

The info was good, but I couldn't stop Laughing as she Mangled & Strangled the English Language

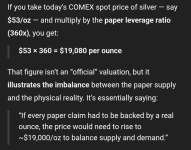

All the analysts who forecasted Silver's rise beyond $50 USD were on the money. The price of silver still looks very retarded when paired next to other PM's.

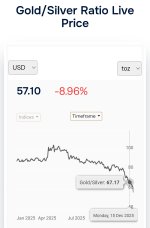

But looky what we have here. We'll be telling stories of when the GSR was once 120:1

I was screaming at my family to buy silver when it dipped below $15 USD in 2018. It was cheaper to buy a 1oz coin from a Bullion dealer than it was for a primary silver mine to extract it out of the ground. I remember joking that I was off to mine some silver when I was on my way to load up

But looky what we have here. We'll be telling stories of when the GSR was once 120:1

I was screaming at my family to buy silver when it dipped below $15 USD in 2018. It was cheaper to buy a 1oz coin from a Bullion dealer than it was for a primary silver mine to extract it out of the ground. I remember joking that I was off to mine some silver when I was on my way to load up

getting ready for next year 2026 gsr 48.32Next gsr 57.48.32 ahead

may be way lower number is a possibility

If the GSR hit 30:1 I'm going to be swapping a good chunk of my Silver for GOLD !getting ready for next year 2026 gsr 48.32

may be way lower number is a possibility

I'm really torn on my gsr trade plan, I had a dream that the GSR went negative and I was trading ounces of silver for gold at 1 for 2.

I know it was just a dream, but I'd hate to trade my silver for gold at 30 and then watch my dream turn into reality.

I know it was just a dream, but I'd hate to trade my silver for gold at 30 and then watch my dream turn into reality.

If silver didn't exist I would've been all in on Gold. Even if the GSR went to 10:1 I would be heavily resistant to trade. There's something about having a NEEDED resource in a supply deficit that's just going to continue to get larger that makes more sense to me. But you never know. My objective to be in silver was to protect my savings from the risks of the system and have enough to buy a house outright. I'm actually not too far away from that reality but the system is still rotten, and holding tangible assets will likely be more fruitful than buying land or property when the target is hit. That will be a tough call for me when the time comes. It will likely be laced with a flood of regrets in hindsight.

Last edited:

It's worth noting that retail investment doesn't appear to be the driver of Silver's surge, nor does it appears to be from paper speculation. This seems to be industry driven and a massive indicator of available aboveground reserves drying up. I think only central bank liquidity could compete with industrial interest driving the prices, and even if they were to smash the price down, it would only be temporarily. We are actually seeing real market forces leading the price discovery front as we enter the beginning of this push towards free-market silver for the first time in about 150 years.

There will likely be a speculation-aided blow off once silver rockets beyond it's free-market determined value. The higher the price of silver goes, the more retail interest it will receive. The argument that the 3 billion Oz's held by stackers and owners of jewellery is null and void because they'll be replaced by new buyers in droves. Your 1000 Oz's will become 50 Oz's held by 20 new entrants to the silver space in a flash. Add the threat of runaway inflation and every man and his dog will be looking for something to grab on to.

Gold is great. Gold has it's own standing as being the king-daddy of money. But Silver's in a league of it's own, piggybacking off the same features of Gold in its historical uses as money but also being the lifeblood of industry and the #1 precious metal driving our technological progress.

There will likely be a speculation-aided blow off once silver rockets beyond it's free-market determined value. The higher the price of silver goes, the more retail interest it will receive. The argument that the 3 billion Oz's held by stackers and owners of jewellery is null and void because they'll be replaced by new buyers in droves. Your 1000 Oz's will become 50 Oz's held by 20 new entrants to the silver space in a flash. Add the threat of runaway inflation and every man and his dog will be looking for something to grab on to.

Gold is great. Gold has it's own standing as being the king-daddy of money. But Silver's in a league of it's own, piggybacking off the same features of Gold in its historical uses as money but also being the lifeblood of industry and the #1 precious metal driving our technological progress.

Good analysis @STKRIt's worth noting that retail investment doesn't appear to be the driver of Silver's surge, nor does it appears to be from paper speculation. This seems to be industry driven and a massive indicator of available aboveground reserves drying up. I think only central bank liquidity could compete with industrial interest driving the prices, and even if they were to smash the price down, it would only be temporarily. We are actually seeing real market forces leading the price discovery front as we enter the beginning of this push towards free-market silver for the first time in about 150 years.

There will likely be a speculation-aided blow off once silver rockets beyond it's free-market determined value. The higher the price of silver goes, the more retail interest it will receive. The argument that the 3 billion Oz's held by stackers and owners of jewellery is null and void because they'll be replaced by new buyers in droves. Your 1000 Oz's will become 50 Oz's held by 20 new entrants to the silver space in a flash. Add the threat of runaway inflation and every man and his dog will be looking for something to grab on to.

Gold is great. Gold has it's own standing as being the king-daddy of money. But Silver's in a league of it's own, piggybacking off the same features of Gold in its historical uses as money but also being the lifeblood of industry and the #1 precious metal driving our technological progress.

Something in Silver/the Market has Broken.

Time & the Market Place will tell us the " REAL " price of an Ounce of SILVER.

And let's not forget the often overlooked mine supply angle. So much talk about where demand is coming from that people seem to neglect the important analysis of supply.

Mexico, the world's largest silver producing country, will be knocked off its throne in the coming years. This will only exacerbate the deficit:

aheadoftheherd.com

aheadoftheherd.com

Another reason why silver shines brighter than gold for me: Aboveground available gold reserves absolutely dwarf silver. Gold (Apparently) isn't in a supply deficit. Gold is also found much deeper in the earth's crust compared to silver, and all the easy to mine silver is already gone, or is already being mined to depletion. The majority of the long-standing (we're talking 40-50+ years) mines in Mexico are set to deplete their reserves within the coming years. This isn't a mexico exclusive event either, many of the largest silver mines have chewed into their available supply, with ore grades declining significantly worldwide.

Take Australia's largest silver mine - The Cannington mine in QLD. They have been hit with significant challenges extracting silver. Here's the kicker: they only produce approx 11 Million Oz's per year and have a remaining lifespan of 6 years! Here we have a huge mining operation that is limited to a wimpy annual production / that does fuck all to offset the growing demand globally. This is a really important detail to understand for all stackers: Below ground reserves are constrained by annual mining output. Even if a mine has a Lifespan of 30 years (most current mines do not), it's still restricted by its annual mining output. A large silver mine may only produce an average of 10-15 Million Oz's a year. We'd need to see 20+ new large mines to come online to offset the current deficit, and ZERO mines to deplete in the same period. What we're about to see is most of the long-standing mines will deplete their resources over the next 2-10 years but very few new mines will come online (for a myriad of reasons).

Silver demand is important... But if you really want to get excited about silver, look into mine supply. That's where the real silver picture begins to take shape. I reckon we'll see mine supply drop from 800+ Mozs to a meagre 600 Mozs by 2035, while the upward trajectory of growing demand continues.

This is again why I believe there'll be a time when governments make private ownership illegal. The days of silver being sold at Bullion dealers are numbered, and government mints will limit their stock to accommodate the growing need for silver in industry. Silver scarcity will be a crisis-level event of significant importance to national security. Private holders are the easiest targets, which will first come in the form of restricting sales at government mints. The same features that make silver shine are also Silver's biggest threat. No surprise governments and some global authority will be the downfall of a long-term stackers dreams.

Mexico, the world's largest silver producing country, will be knocked off its throne in the coming years. This will only exacerbate the deficit:

Mexico could run out of silver by 2026, worsening supply deficit – Richard Mills

2024.01.13 The world’s largest silver producer could mine all of its existing reserves […]

Another reason why silver shines brighter than gold for me: Aboveground available gold reserves absolutely dwarf silver. Gold (Apparently) isn't in a supply deficit. Gold is also found much deeper in the earth's crust compared to silver, and all the easy to mine silver is already gone, or is already being mined to depletion. The majority of the long-standing (we're talking 40-50+ years) mines in Mexico are set to deplete their reserves within the coming years. This isn't a mexico exclusive event either, many of the largest silver mines have chewed into their available supply, with ore grades declining significantly worldwide.

Take Australia's largest silver mine - The Cannington mine in QLD. They have been hit with significant challenges extracting silver. Here's the kicker: they only produce approx 11 Million Oz's per year and have a remaining lifespan of 6 years! Here we have a huge mining operation that is limited to a wimpy annual production / that does fuck all to offset the growing demand globally. This is a really important detail to understand for all stackers: Below ground reserves are constrained by annual mining output. Even if a mine has a Lifespan of 30 years (most current mines do not), it's still restricted by its annual mining output. A large silver mine may only produce an average of 10-15 Million Oz's a year. We'd need to see 20+ new large mines to come online to offset the current deficit, and ZERO mines to deplete in the same period. What we're about to see is most of the long-standing mines will deplete their resources over the next 2-10 years but very few new mines will come online (for a myriad of reasons).

Silver demand is important... But if you really want to get excited about silver, look into mine supply. That's where the real silver picture begins to take shape. I reckon we'll see mine supply drop from 800+ Mozs to a meagre 600 Mozs by 2035, while the upward trajectory of growing demand continues.

This is again why I believe there'll be a time when governments make private ownership illegal. The days of silver being sold at Bullion dealers are numbered, and government mints will limit their stock to accommodate the growing need for silver in industry. Silver scarcity will be a crisis-level event of significant importance to national security. Private holders are the easiest targets, which will first come in the form of restricting sales at government mints. The same features that make silver shine are also Silver's biggest threat. No surprise governments and some global authority will be the downfall of a long-term stackers dreams.

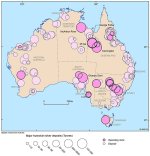

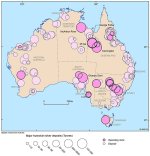

Australia has a decent amount of silver reserves... But if you look at this image, you'll see most of the large deposits are already being mined. This is an old infographic, but still relevant. Many of the known deposits are between 50-500 tonnes or less. That's 1.6 to 16 Million ounces. There's a reason they don't have a mine on them already, it's because they're not economically feasible, and the mine lifespan would be extremely short. The majority of the deposits with existing mines aren't targeting silver either.

I hope it works out for you. I personally don't see a swing back to a higher GSR until the market becomes heavily speculation driven. By that time we'll probably encounter a single digit GSR.If the GSR hit 30:1 I'm going to be swapping a good chunk of my Silver for GOLD !

I still don't think we're seeing shortages yet. There are signs but until the Bullion dealers and government mints have a hard time getting their hands on silver, we can't be saying there's a real shortage. The best thing is we get to watch/investigate this in real-time. I do, however, believe we are at the beginning of something significant. Silver has been undervalued for decades, and it was all riding on the fact we had billions of Oz's of aboveground reserves when the world stopped using silver in our coins. It would appear these stockpiles weren't held by local governments but sold off to the reserve currency holder - The US of A - to help maintain its reserve status. I think from estimates it was approx. 10 billion Oz's of silver by the late 1960's that was deemed available aboveground supply.

View: https://x.com/i/status/2004567040389198060

View: https://x.com/i/status/2004567040389198060

Last edited:

I still don't think we're seeing shortages yet. There are signs but until the Bullion dealers and government mints have a hard time getting their hands on silver, we can't be saying there's a real shortage. The best thing is we get to watch/investigate this in real-time. I do, however, believe we are at the beginning of something significant. Silver has been undervalued for decades, and it was all riding on the fact we had billions of Oz's of aboveground reserves when the world stopped using silver in our coins. It would appear these stockpiles weren't held by local governments but sold off to the reserve currency holder - The US of A - to help maintain its reserve status. I think from estimates it was approx. 10 billion Oz's of silver by the late 1960's that was deemed available aboveground supply.

View: https://x.com/i/status/2004567040389198060

Yeah, just bullshit & hype ATM.

U will know real Silver shortages when Gov makes Decrees/Rulings/Laws around the purchase/sale of Silver.

That's when the REAL Action will start

Stupid fuckers suppressed the price for so long they drove production into the Gutter. Now they pay the Price

I'm sitting on my Stack until Silver is GSR at least 30:1

ABC's spot price is almost $7 above actual spot. $144 they're asking for a 1oz kangaroo. That's $26 above spot! It wasn't that long ago you couldn't sell your silver for $26.

Even their kilo bars work out to be $17 over spot. In 2020 silver dipped down to $19 AUD spot price. Kilo bars were $600. It really goes to show how long silver was held down for, and just how absurd the price was for almost a decade since the last major bull run of 2011

ABC's inconsistent spot price is rather telling. They go from 30 cents to almost $7 over actual spot. All other bullion dealers maintain a healthy spot price margin that doesn't deter their customers. There's been a shift in ABC's business model which started with them pricing their 1oz kangaroo coins at a much higher level than any other government minted coin on their website (I speculate this was an agreement made with Perth Mint, as ABC would've been the largest re-seller of kangaroos prior to the price hike). I can't shake the feeling they've been financially incentivised to deter investment in silver to boost available supply for other entities. It seems crazy to say this but nothing about what they're doing makes sense from a Bullion dealer perspective, but makes total sense for a global refiner who's been contracted to supply silver to the wholesale market. The question remains: Who is getting their supply? The LBMA, COMEX, SHANGHAI ... Or all of the above?

Even their kilo bars work out to be $17 over spot. In 2020 silver dipped down to $19 AUD spot price. Kilo bars were $600. It really goes to show how long silver was held down for, and just how absurd the price was for almost a decade since the last major bull run of 2011

ABC's inconsistent spot price is rather telling. They go from 30 cents to almost $7 over actual spot. All other bullion dealers maintain a healthy spot price margin that doesn't deter their customers. There's been a shift in ABC's business model which started with them pricing their 1oz kangaroo coins at a much higher level than any other government minted coin on their website (I speculate this was an agreement made with Perth Mint, as ABC would've been the largest re-seller of kangaroos prior to the price hike). I can't shake the feeling they've been financially incentivised to deter investment in silver to boost available supply for other entities. It seems crazy to say this but nothing about what they're doing makes sense from a Bullion dealer perspective, but makes total sense for a global refiner who's been contracted to supply silver to the wholesale market. The question remains: Who is getting their supply? The LBMA, COMEX, SHANGHAI ... Or all of the above?

Last edited:

It's starting to make more sense. 2021-22 was around the time they began listing the 1oz kangaroo coins at a much higher premium. Silver was being funnelled off to the COMEX and I'm pretty confident there's a connection between the two. This was also around the time when a selection of Perth Mint bars became unavailable. It would appear Perth Mint and ABC Bullion have been working to reduce investment load and send as much silver as possible to the COMEX without raising alarm bells. This just tells me the silver shortage is far more dire than expected.