Devalue the USD = Gold To Da Moon

Chinese have sold treasuries and buying metal (Yeah we know that)

The United States Bullion Depository at Fort Knox, Kentucky (commonly just called Fort Knox), officially holds approximately 147.3 million troy ounces of gold bullion. This represents a little over half of the total U.S. Treasury-owned gold reserves (which total around 261.5 million ounces across various locations).

- This figure comes directly from official U.S. Treasury and U.S. Mint sources, including their Fiscal Data reports and the Mint's own site.

- The amount has remained stable for many years, with no major transfers reported—only tiny samples occasionally removed for purity testing during audits.

- At the government's statutory book value (fixed since 1973 at $42.22 per ounce), it's carried on the books at roughly $6.2 billion for Fort Knox's portion.

- At current market prices in 2026 (which have been well over $4,000–$4,500 per ounce in recent reports), the market value exceeds $660 billion for that stash alone.

The U.S. Treasury conducts ongoing

internal audits and seal checks annually, with the gold described as "present and accounted for" by officials (including recent statements from the Treasury Secretary). The last partial public inspection-style visit was in 2017, and while full physical audits of every bar haven't happened publicly since the 1970s (due to the massive scale—over 368,000 bars), official records and continuing verification's confirm the holdings.

Conspiracy theories about the vaults being empty have circulated for decades (fueled by secrecy, the lack of public tours, and the old book value), and there have been recent calls (including from figures like Trump, Musk, Rand Paul, and Rep. Thomas Massie) for a more transparent, independent audit—but no evidence has emerged showing the gold is missing.

Official sources consistently affirm it's still there.

Next

With gold smashing through $4,800+ and still climbing (and no sign of stopping in early 2026), a lot of the rocket fuel is coming straight from China.

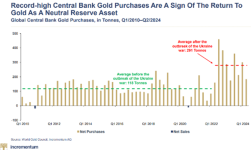

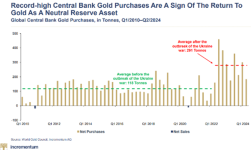

The People's Bank of China (PBOC) just reported another tiny bump in December 2025 – up 30,000 oz to about 74.15 million oz (~2,306 tonnes) – marking 14 straight months of official buys. That's on top of massive household and ETF demand inside China, plus arbitrage plays pushing prices higher. But why is China stacking like there's no tomorrow? It's not random – it's strategic, and it ties directly into de-dollarization plans that could reshape the global game.

Key reasons China is aggressively buying gold:

Diversification away from the USD – China holds trillions in forex reserves, but a big chunk is still in US Treasuries (which they've been quietly dumping to 17-year lows). Gold is the ultimate neutral asset: no counterparty risk, no sanctions vulnerability (see what happened to Russia's frozen reserves).

Analysts like those at Julius Baer and J.P. Morgan say the PBOC's main motive is reducing dollar dependence and hedging against potential US sanctions or dollar weaponization.

Geopolitical hedging & safe-haven demand – Trade wars, tariffs (including threats over Greenland, etc.), and broader US-China tensions are ramping up uncertainty. Gold is the classic hedge.

Chinese households are piling in too – record ETF inflows (RMB112bn in 2025), bars/coins demand up big – seeing gold as protection amid economic slowdowns and property woes.

Backing the yuan and challenging dollar dominance – This is the big picture. China wants the yuan (RMB) to play a bigger global role. Gold builds credibility for that. They're also pushing yuan settlements in bilateral trade (already huge with Russia, and growing elsewhere). In BRICS (now expanded), there's ongoing talk of a blockchain-based payment system (BRICS Pay/Bridge) for local-currency trades, and even ideas for a commodity/gold-linked settlement unit to bypass SWIFT/dollar entirely.

China leads this – they produce the most gold globally and hold massive reserves (official numbers likely understated; some analysts guess real holdings could be double or more via state entities).

Long-term Chinese plans:

Accelerate de-dollarization through BRICS+ initiatives:

More trade in yuan/rubles/etc., alternative payment rails, and gold as a reserve anchor.

Position gold as a tool of financial influence:

They've even offered gold storage to foreign banks (Cambodia already took it up).

Build toward multipolar finance: If central banks keep buying (global CB demand still 700-1000+ tonnes/year projected), gold could soon rival or exceed dollar holdings in some reserve baskets. China/Russia/BRICS allies are front-running that shift.

For us stackers:

This isn't bearish for gold – it's super bullish. China's actions (plus other CBs) create a structural floor under prices. Demand is real, physical, and institutional – not just paper speculation. The higher gold goes, the more it validates the "stack physical while you can" mindset, especially if dollar confidence wobbles further.

Best to all.

Guys my comments are a precis of my discussions with Grok; DYODD and best to all.